what is suta taxable wages

Leading tax software providers make their online products. General employers are liable if they have had a quarterly payroll of 1500.

In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

. If the employer paid. To calculate the amount of tax to be paid by an employer multiply the amount of taxable wages paid during the quarter by the employers effective tax rate. It serves the same purpose as the.

You have employees with the. Since your business has no history of laying off employees your SUTA tax rate is 3. Base Tax Rate for 2022 from 050 to 010.

The State Unemployment Tax Act commonly referred to as SUTA tax is a state unemployment insurance program requiring employers to pay towards a fund. In some cases however the employee. Assume that your company receives a good assessment and your.

Benefit wage charges BWC are the taxable base period wages reported by an employer to OESC through the quarterly wage reports which are not to exceed the annual limit. Even though you only pay unemployment taxes on the taxable wage base you still must report all. Special Assessment Federal Loan Interest Assessment for.

State Unemployment Tax Act is also known as SUTA state unemployment insurance and SUI. Additional Assessment for 2022 from 1400 to 000. Employers are liable for unemployment tax in Virginia if they are currently liable for Federal Unemployment Tax.

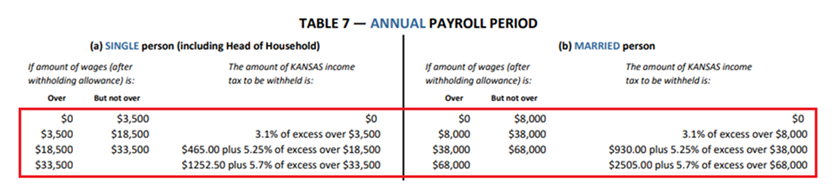

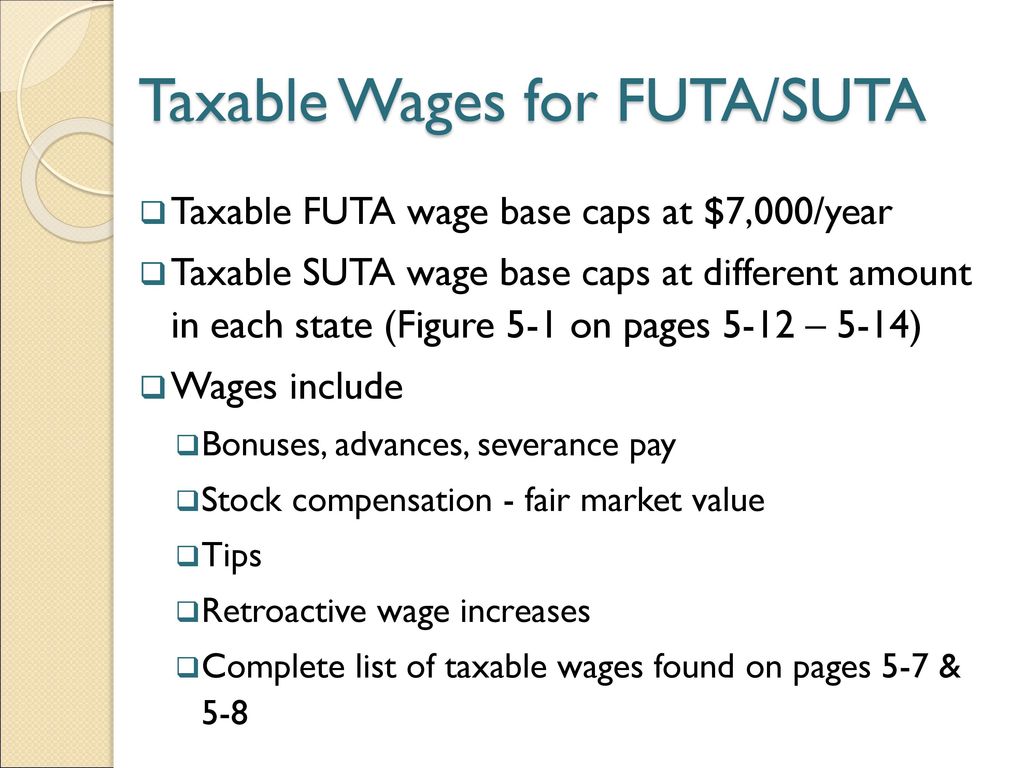

Wages do not include jury-duty pay death benefits or sick leave under a qualified plan. The amount of the tax is based on the employees wages and the states unemployment rate. So beyond that threshold the employees wages wouldnt be taxed for SUTA purposes.

The State Unemployment Tax Act SUTA tax is typically a payroll tax paid on employee wages by all employers. The Reemployment Tax is exclusive to Florida and the Florida Department of Revenue has administered the tax since 2000. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages.

The states SUTA wage base is 7000 per employee. The new law reduces the. It is a payroll tax that goes towards the state unemployment fund.

The taxable wage base is the maximum amount of income that is taxed. The taxable wage base for the Federal Unemployment Tax Act FUTA you pay UI tax on each employees wages up to the taxable wage base you do not pay tax on wages exceeding the. IRS Free File is available to any person or family with an adjusted gross income AGI of 73000 or less in 2021.

What is SUTA tax.

Suta Tax An Employer S Guide To The State Unemployment Tax Act

.jpg)

Az No State Withholding On Payroll Check Das

Tax Liabilities Report S247 Asap Help Center

What Is Sui Tax And How Do I Pay It Hourly Inc

Solved The Employees Of Portonegra Company Earn Wages Of 15 600 For The Two Weeks Ending April 12

Solved The Following Information Pertains To A Weekly Payroll Of Fanelli Fashion Company A The Total

What Is Suta Tax Definition Rates Example More

What Is Sui State Unemployment Insurance Tax Ask Gusto

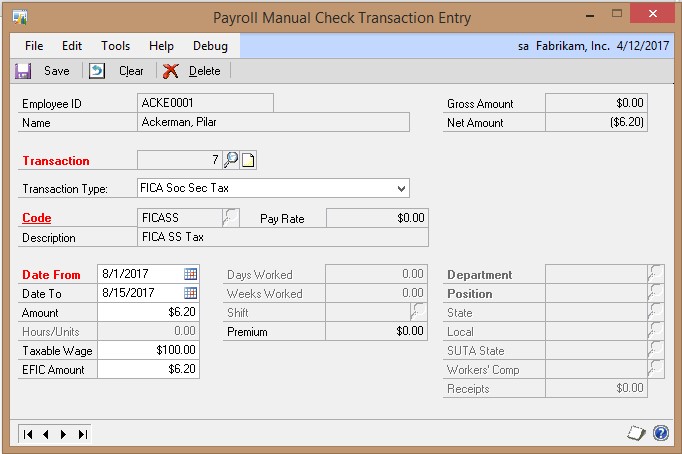

Dynamics Gp U S Payroll Dynamics Gp Microsoft Learn

What Is Suta Tax And Who Pays It

Fast Unemployment Cost Facts For Montana First Nonprofit Companies

Payroll Best Practices What S New Presenter Mike Lasanowski Payroll Specialist Customer Conference Ppt Download

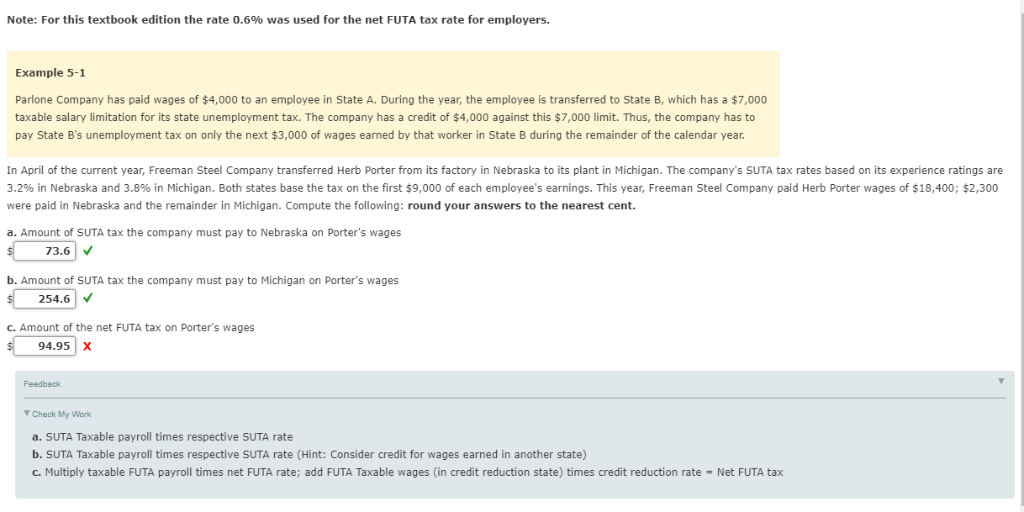

Solved I Need Help With C Please I Cannot Figure Out How Chegg Com

2022 Suta Taxes Here S What You Need To Know Paycom Blog

Fast Unemployment Cost Facts For Washington First Nonprofit Companies

Chapter 5 Payroll Accounting 2011 Unemployment Compensation Taxes Ppt Download

Strong And Equitable Unemployment Insurance Systems Require Broadening The Ui Tax Base Economic Policy Institute